Our Services

We deliver innovative digital financial solutions that enable banks, MDIs, MFIs, Fintechs, and SACCOs to rapidly design, launch, and scale financial services seamlessly and securely.

Comprehensive financial technology solutions designed to empower banks, microfinance institutions, and businesses across Uganda.

Time to Market

Scalability

Integration Cost

Security Standards

We deliver innovative digital financial solutions that enable banks, MDIs, MFIs, Fintechs, and SACCOs to rapidly design, launch, and scale financial services seamlessly and securely.

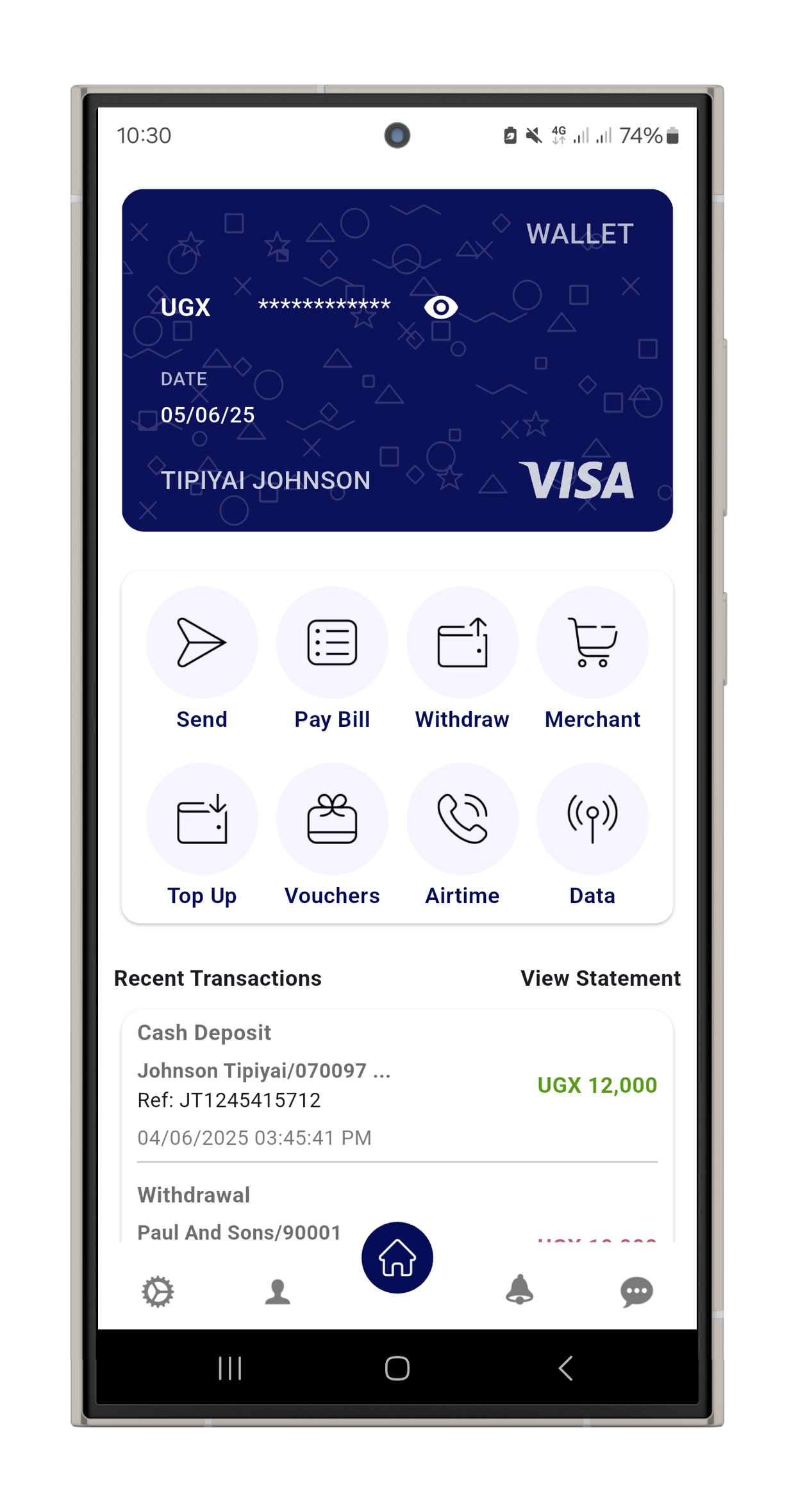

Deliver Secure, Real-Time Banking Anywhere.

Are you a Bank, MDI, MFI, CI, SACCO, or Fintech looking to provide your customers with secure, real-time access to financial services on their mobile phones—without building infrastructure from scratch? Our enterprise-grade Mobile Banking Platform enables you to launch a full suite of digital financial services—faster, more securely, and at lower cost.

Expand Your Reach with a Ready-to-Deploy, Secure & Scalable Agent Network.

Are you a Bank, MDI, MFI, CI, SACCO, or Fintech looking to rapidly access or deploy an agent network—without incurring high technology or operational costs? Our Agent Platform enables you to leverage an existing network of agents or deploy your own—faster, cheaper, and with enterprise-grade reliability.

Empower Your Business Clients to Accept Digital Payments — Quickly, Securely, and Affordably

Are you a Bank, MDI, MFI, CI, SACCO, or Fintech looking to enable your business customers to acquire payments from bank, mobile money and fintech customers without heavy investment? Our Merchant Platform helps you launch & scale faster, at lower cost.

Seamless, Secure & Scalable Online Transactions

Are you a Bank, MDI, MFI, CI, SACCO, or Fintech looking to empower your individual and business clients to make secure digital transactions—without the burden of heavy IT investments? Our white-label Online Payments platform enables you to launch and scale fully branded online payment services — faster, cheaper, and with bank-grade reliability.

Launch Digital Payments Fast

Are you a Bank, MDI, MFI, CI, SACCO, or Fintech looking to embed seamless digital payment services into your platforms—without the hassle of building from scratch? With ABC’s Open APIs, you can launch a complete suite of services in days, not months. Our APIs are designed for easy integration, enabling you to serve individuals and businesses with secure, real-time payments, digital onboarding, Our comprehensive API ecosystem enables seamless integration with our financial services platform. Build innovative products, extend your service offerings, and create custom solutions with loan services, and remittances—all backed by our reliable infrastructure.

Issue. Accept. Manage. Digitally.

Are you a Bank, MDI, MFI, CI, SACCO, or Fintech looking to offer secure, branded payment cards—without the complexity of international card schemes? Our Closed-Loop Card Platform enables you to issue, acquire, and manage cards for customers, agents, and merchants—while maintaining full control and lowering costs.Bank-grade security protocols and full regulatory compliance across all platforms and services.

Our platforms grow with your business, from startup to enterprise-level operations.

24/7 technical assistance and personalized account management for all partners.

Tailor our solutions to your specific business requirements and customer needs.

Deep understanding of African markets and financial ecosystems.

We succeed when you succeed – committed to long-term, mutually beneficial relationships.

Contact us today to learn how our platforms can help you reach more customers and reduce operational costs.

Get in Touch