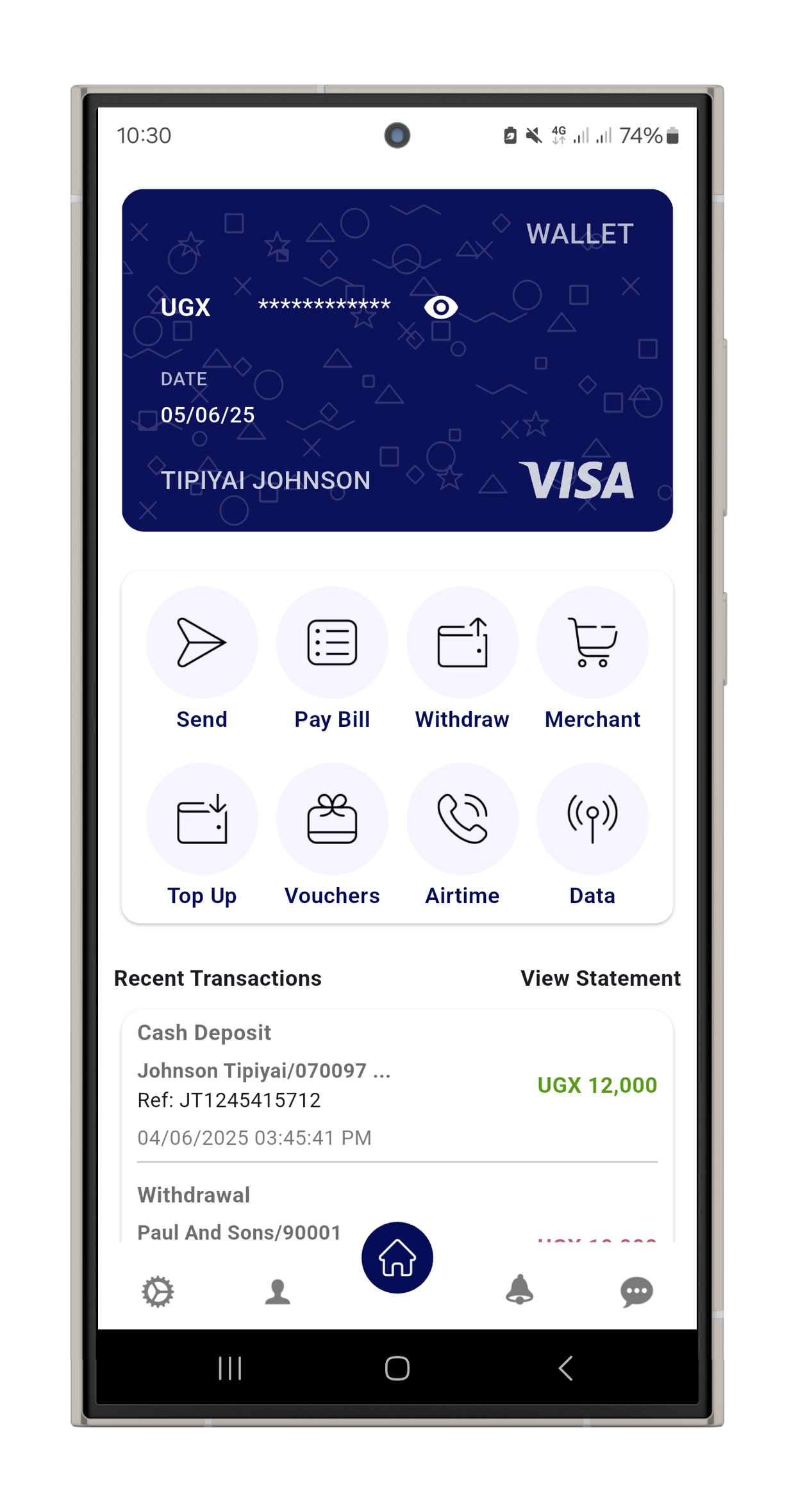

Agent Banking Company (ABC)

Empowering financial institutions with innovative technology solutions

At Agent Banking Company, we are dedicated to transforming Uganda's financial landscape through the provision of scalable, secure, and interoperable financial services platforms. With our integrated suite of services, we enable banks, MDIs, MFIs, SACCOs, fintechs, and other financial institutions to enhance their service delivery, expand their reach, and reduce operational costs.

Learn More About Us

19

Financial Institutions through 22,000+ agents

Nationwide

Coverage

100%

Secure Transactions